More than half of U.S. businesses are small businesses – and over half of them fail, the Bureau of Labor Statistics reports. Because of that, many business owners are looking for extra funding and even help from the federal government.

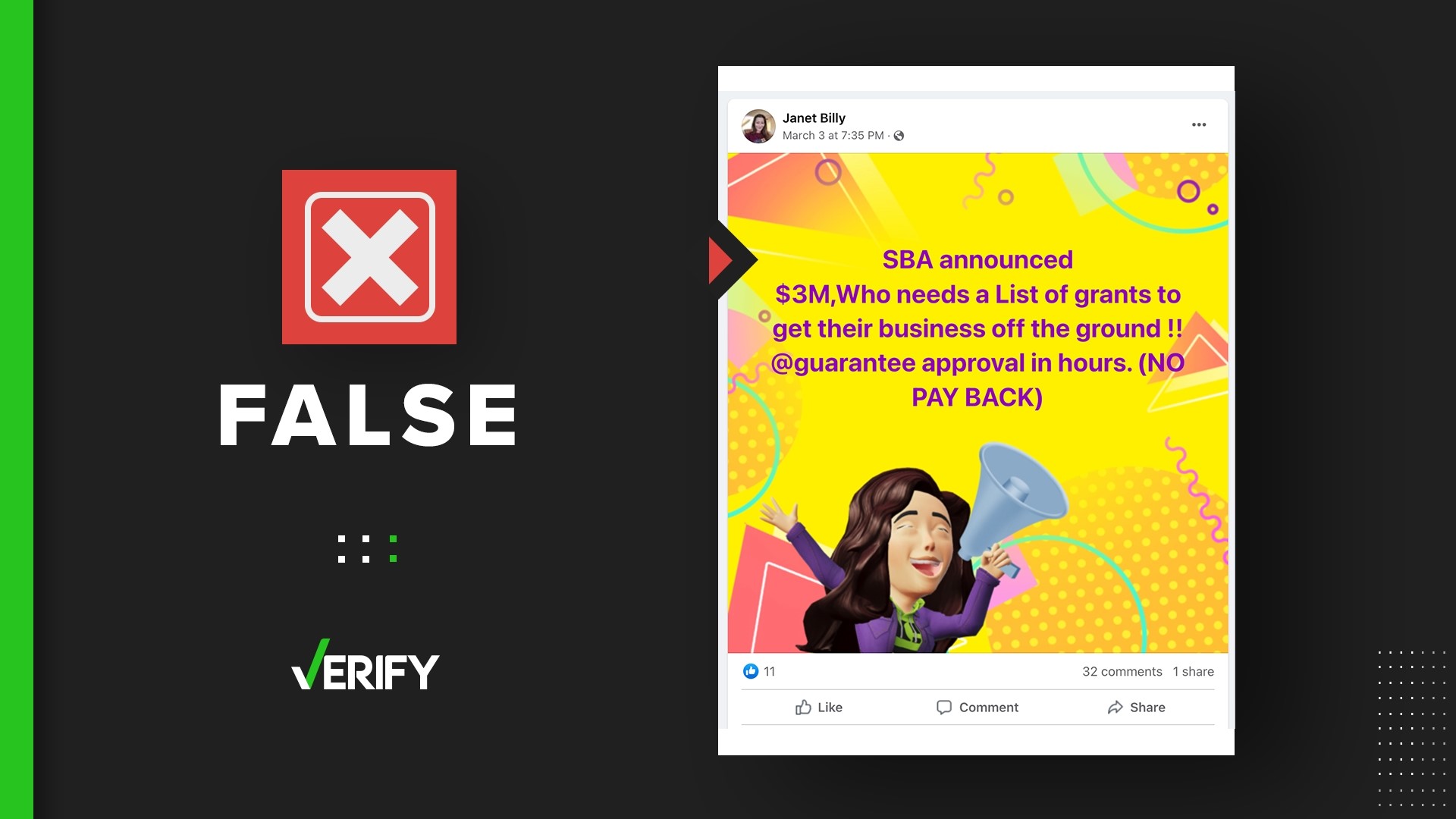

But when Byron messaged us some Facebook posts saying the Small Business Administration is giving small business loans ranging from thousands to millions of dollars, with a no-payback promise, he was skeptical.

“SBA announced $60K, Who needs a List of grants to get their business off the ground … guarantee approval in hours. (NO PAY BACK),” one post said.

Another post said, “Call all Business owners out here !!NEW GRANT OUT FUNDING FOR $50,000. MUST HAVE A LLC OR EIN!! And 25,000 for Individual Application. Don't miss OUT again!!!!”

THE QUESTION

Are these Facebook posts about small business loans or grants legitimate?

THE SOURCES

- U.S. Small Business Administration

- U.S. Department of Health and Human Services, which runs Grants.gov

- RevEye, a reverse image search tool

THE ANSWER

No, these Facebook posts aren’t legitimate.

WHAT WE FOUND

There are legitimate small business loans and grants that are available through government programs, but these Facebook posts are scams.

VERIFY analyzed several factors to find out whether these posts are legitimate offers.

First, we went to the Small Business Administration (SBA) and the U.S. Department of Health and Human Services, which runs Grants.gov, a website where small business owners can apply for various grants.

The first red flag is the application fee mentioned in some of the posts. It’s free to apply for government grants, and you can apply directly without going through a third party.

“If you are contacted by someone promising to get approval of an SBA loan, but requiring any payment up front or offering a high-interest bridge loan in the interim, suspect fraud,” the SBA says.

According to the SBA, there are legitimate brokers who help business owners apply for loans, but they are strictly regulated. For example, real brokers charge a fee based on the loan amount, not an upfront fee.

Also, the posts claim applicants will receive approval within hours – that’s also false. The SBA and Grants.gov both say it takes at least a week for the application to be reviewed, and it could take even longer to process.

We then looked at the individual posts themselves.

VERIFY found several Facebook posts advertising these small business loans or grants with varying dollar amounts. Nearly all of them had identical text – which is an indication this is a copypasta meme scam.

Copypasta is internet slang for a block of text that gets copied and pasted repeatedly.

One example allegedly came from someone named Janet Billy, who posted in a group for Houston-based food truck owners. When we used RevEye, a reverse image search tool, we found this person is not named Janet Billy and is not a Houston food truck owner.

The reverse image search actually led us to the profile of Dani Daniels, a Los Angeles-based adult film star whose Instagram profile says, “Don’t fall for scammers pretending to be me.”

To apply for a real small business loan or grant, visit Grants.gov to check your eligibility or to the SBA’s website to find out how to get a loan through a lender. To report suspected small business loan fraud, contact the SBA OIG Hotline directly.