As inflation continues to climb in the U.S., the cost of everything from food to energy is rising along with it. The Consumer Price Index, the most widely used measure of inflation, increased 8.3% in April 2022 compared to one year earlier, according to the U.S. Bureau of Labor Statistics.

In its most aggressive move in more than 20 years, the Federal Reserve raised its benchmark interest rate by a half-percentage point on May 4 in an attempt to combat rising inflation.

The overall cost of buying a home has increased, as the 30-year mortgage rate in the U.S. climbed to its highest level in 30 years. Now, some news headlines claim that it will soon be more expensive to take out a federal student loan, too.

THE QUESTION

Are interest rates for new federal student loans set to increase for the 2022-2023 academic year?

THE SOURCES

- U.S Department of the Treasury

- Bipartisan Student Loan Certainty Act of 2013

- Bankrate, consumer financial services company

- Federal Student Aid (FSA), an office of the U.S. Department of Education

THE ANSWER

Yes, interest rates for new federal student loans are set to increase for the 2022-2023 academic year.

WHAT WE FOUND

The increased interest rates will only apply to new federal student loans. Interest rates on federal student loans are always fixed, meaning they only apply to loans taken out for that specific year, Bankrate explains on its website.

In this case, that would be the 2022-2023 academic year, for which the rates will be set on July 1, 2022 for loans disbursed from that date through June 30, 2023.

Federal Perkins loans have a fixed interest rate of 5% and won’t be impacted by the rate hike.

According to Bankrate, federal student loan interest rates are determined based on the “high yield of the last 10-year Treasury note auction in May, plus a margin that varies based on the type of loan.”

Ten-year Treasury yields are bonds issued by the federal government that mature in a decade. While the Federal Reserve doesn’t directly set Treasury yields, they typically rise alongside Fed rate increases.

The margin for student loan interest rates is determined by the Bipartisan Student Loan Certainty Act of 2013, which became federal law in August of that same year.

It sets the annual interest rate for direct subsidized and unsubsidized undergraduate loans at the rate on the high-yield 10-year Treasury note, plus 2.05%. For graduate unsubsidized loans, the interest rate is set at the 10-year Treasury rate plus 3.6%.

The annual interest rate for PLUS loans, federal loans for graduate or professional students and parents of undergraduate students, is set at the 10-year Treasury rate plus 4.6%.

All interest rates are also capped at a certain percentage under the law: 8.25% for undergraduate loans; 9.5% for graduate loans; and 10.5% for PLUS loans.

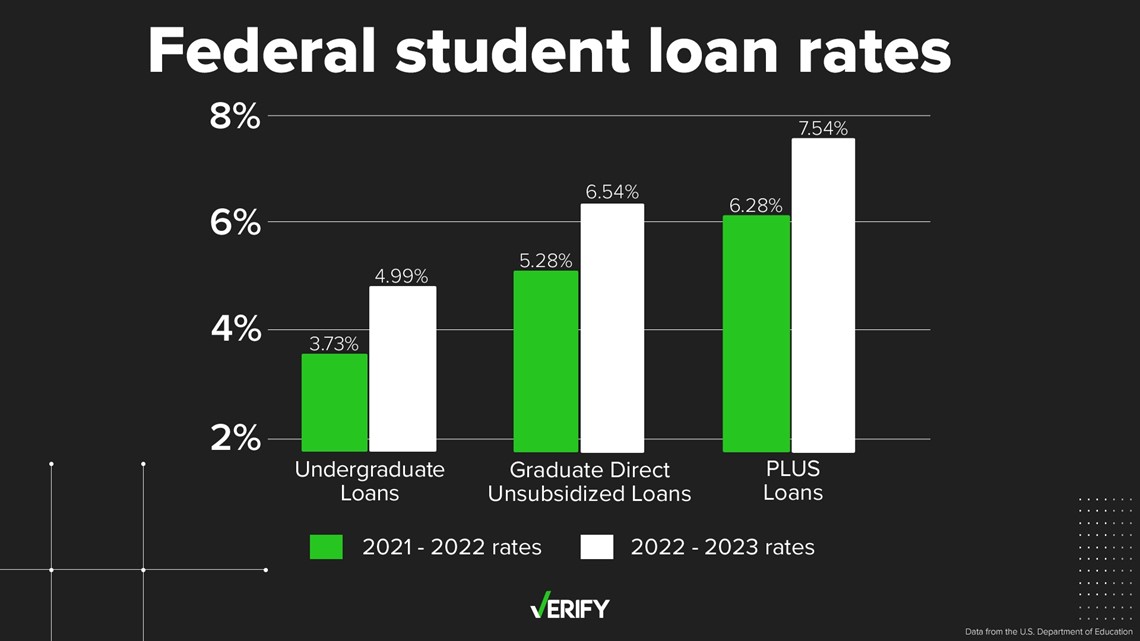

On May 11, the Treasury sold 10-year notes at an interest rate of 2.94%. Here’s what that means for student loan interest rates during the 2022-2023 academic year:

- 4.99% for undergraduate loans

- 6.54% for graduate loans

- 7.54% for PLUS loans

With the upcoming increase, the undergraduate student loan interest rate will be at its highest since 2018-2019. Data from Federal Student Aid (FSA) show the rate during that academic year, before the COVID-19 pandemic began, was 5.05%.

The rate hike will also mark a 1.26% increase from the 2021-2022 academic year’s interest rate of 3.73%.

The U.S. Department of Education announced on April 6 that it extended the student loan payment pause through Aug. 31, 2022. That means student loan payments are still temporarily suspended and the interest rate for loans is 0% for the time being.

It’s unclear whether President Joe Biden will further extend the payment pause, though he has signaled that he’s looking to forgive some federal student loan debt.