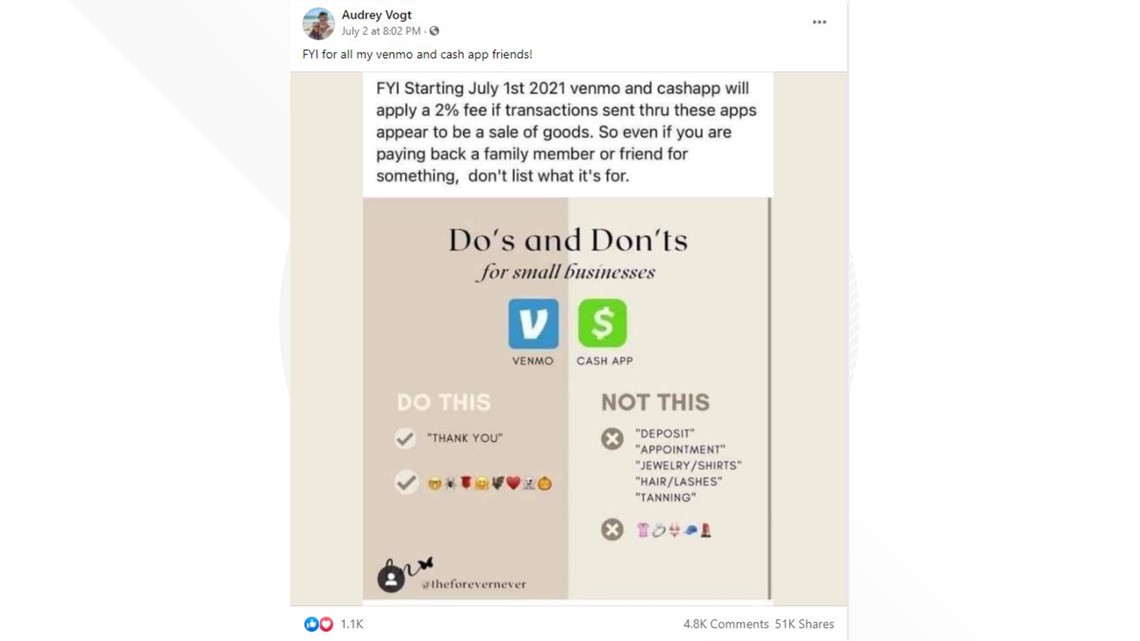

Several memes have gone viral on social media attempting to explain the policies behind transactional apps like Venmo and Cash App and how they might affect small business owners.

A meme posted to Facebook on July 2 offers a do’s and don’ts guide for small businesses that might use the applications for transactions. The meme, which has been shared more than 50,000 times, claims the apps started charging a new 2% fee for certain transactions beginning on July 1.

THE QUESTION

Are Venmo and Cash App charging new service fees for goods and services?

THE SOURCES

THE ANSWER

Yes, Venmo is, but Cash App isn’t. On July 20, Venmo is launching new features that includes a service fee for certain transactions. Cash App has not changed its fee structure.

WHAT WE FOUND

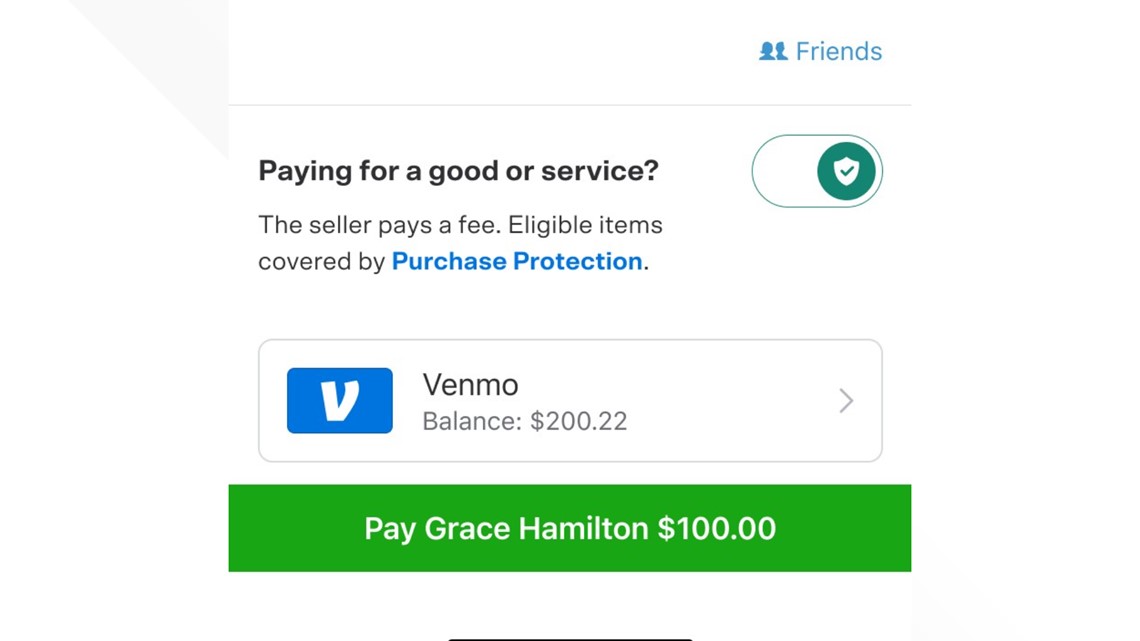

According to PayPal, which owns Venmo, the app will be rolling out “new payment types and expanded purchase protections that will enable customers to safely send and receive payments for goods and services.”

But, the meme shared on Facebook wasn’t entirely correct - these changes will not go into effect until July 20. A post shared to Instagram, shared June 24 with more than 52,000 likes, said the changes would be going into effect on July 21 - also incorrect.

A user would also have to “opt-in” to indicate if the payment is for goods or services, a PayPal spokesperson told VERIFY. If a buyer indicates they are paying for a good or service, the seller would pay a fee, which is 1.9% of the transaction, plus 10 cents.

On Cash App, none of the policies have changed. If someone has a Cash for Business account, there is a 2.75% fee applied to every payment received. If someone has a regular Cash App account, standard deposits are free and arrive within one to three business days. Instant Deposits are subject to a 1.5% fee (with a minimum fee of $0.25) but arrive to a debit card instantly.

VERIFY

Our journalists work to separate fact from fiction so that you can understand what is true and false online. Please consider subscribing to our daily newsletter, text alerts and our YouTube channel. You can also follow us on Snapchat, Twitter, Instagram or Facebook.