On June 8, Illinois Gov. J.B. Pritzker, a Democrat, claimed former President Donald Trump lowered billionaires’ taxes while raising them for many Americans during a speech at the Wisconsin Democratic Party Convention.

“Trump turned his back on working families struggling to make ends meet and then boosted his rich corporate friends,” Pritzker said. “He lowered taxes on billionaires and raised them on everyone else.”

Similar claims have been circulating on social media for several years.

THE QUESTION

Did Donald Trump lower taxes on billionaires and raise them on everyone else?

THE SOURCES

THE ANSWER

No, Donald Trump did not lower taxes on billionaires and raise them on everyone else.

WHAT WE FOUND

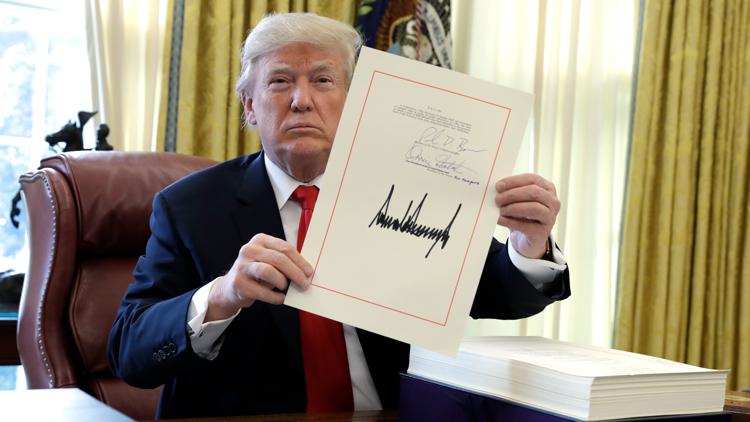

Former President Donald Trump did not lower taxes on billionaires and raise them on everyone else like Pritzker claimed. Instead, the Tax Cuts and Jobs Act, federal tax reform legislation signed into law by Trump in 2017, essentially cut income tax rates across the board.

According to the Tax Foundation, the Tax Cuts and Jobs Act, which went into effect in 2018, reduced average tax rates for taxpayers at all income levels because it lowered marginal tax rates, widened tax brackets, and doubled the child tax credit.

The tax reform law also zeroed out personal and dependent exemptions, nearly doubled the standard deduction, and limited several itemized deductions and the alternative minimum tax, among other changes.

“Although not every change the TCJA made was a tax cut—the net effect of all changes taken together was to reduce average tax burdens,” the Tax Foundation said.

From 2017 to 2018, for example, the Tax Foundation says the average tax rate dropped from 4% to 3.4% for the bottom half of income earners; and from 26.8% to 25.4% for the top 1% of earners.

“Average rates declined across all income groups and have remained below their 2017 levels since,” the Tax Foundation said.

A 2018 Tax Policy Center report also said that the Tax Cut and Jobs Act would reduce individual income taxes on average for all income groups in all states. Their analysis of the law estimated that it would cut individual income taxes for 65% of households in 2018.

Pritzker’s office cited a Center on Budget and Policy Priorities analysis that suggested the 2017 Trump-era tax law was “skewed to the rich, expensive, and failed to deliver on its promises.”

The analysis states that the cuts are skewed toward the rich, with the estimated average savings in 2025 of $70 per person for the lowest 20% of earners (up to $27,300) and of $61,090 for the top 1% (income of $837,800 or more).

Most of the individual tax provisions in the Tax Cuts and Jobs Act are set to expire on Dec. 31, 2025. After 2025, without specific action by Congress, tax rates, the standard deduction and other tax provisions will revert back to the laws in effect before the tax reform legislation became law.

This story was reported in collaboration with Wisconsin Watch, a member of the Gigafact network, and was originally reported by Tom Kertscher.