WASHINGTON — Editor’s Note:

After the publication of this story, on Feb. 7, the IRS announced it will “transition away” from and eventually no longer use “a third-party service for facial recognition” to authenticate new online accounts. On Feb. 8, Id.me announced they are adding a new option to verify people's identities, using a “human agent” instead of “using automated facial recognition.” Additionally, beginning March 1, the company said anyone with an Id.me account will be able to delete their selfie at account.ID.me

As the IRS is beefing up its sign-in and verification process to thwart identity theft, some people are skeptical of handing over their sensitive information, including a selfie video of their face.

Last November the IRS announced that it had partnered with security company ID.me, based in Mclean Virginia, to upgrade account security.

"The IRS has been working hard to make improvements in this area, and this new verification process is designed to make IRS online applications as secure as possible for people," IRS Commissioner Chuck Rettig said.

Lots of people have been taking to social media to voice their concern about having to submit a facial scan in order to view important tax documents.

Among the debate, our Verify researchers noticed there was confusion as to whether people would need to create an account (and take a selfie) in order to file their 2021 taxes.

THE QUESTION:

Will you need to do a facial scan to file your taxes this year?

THE SOURCES:

- Internal Revenue Service (IRS)

- Blake Hall- co-founder and CEO, ID.me

THE ANSWER:

No, according to Hall and an IRS statement, you will not need to create an ID.me account, which matches a selfie video to a photo ID, to file your taxes.

WHAT WE FOUND:

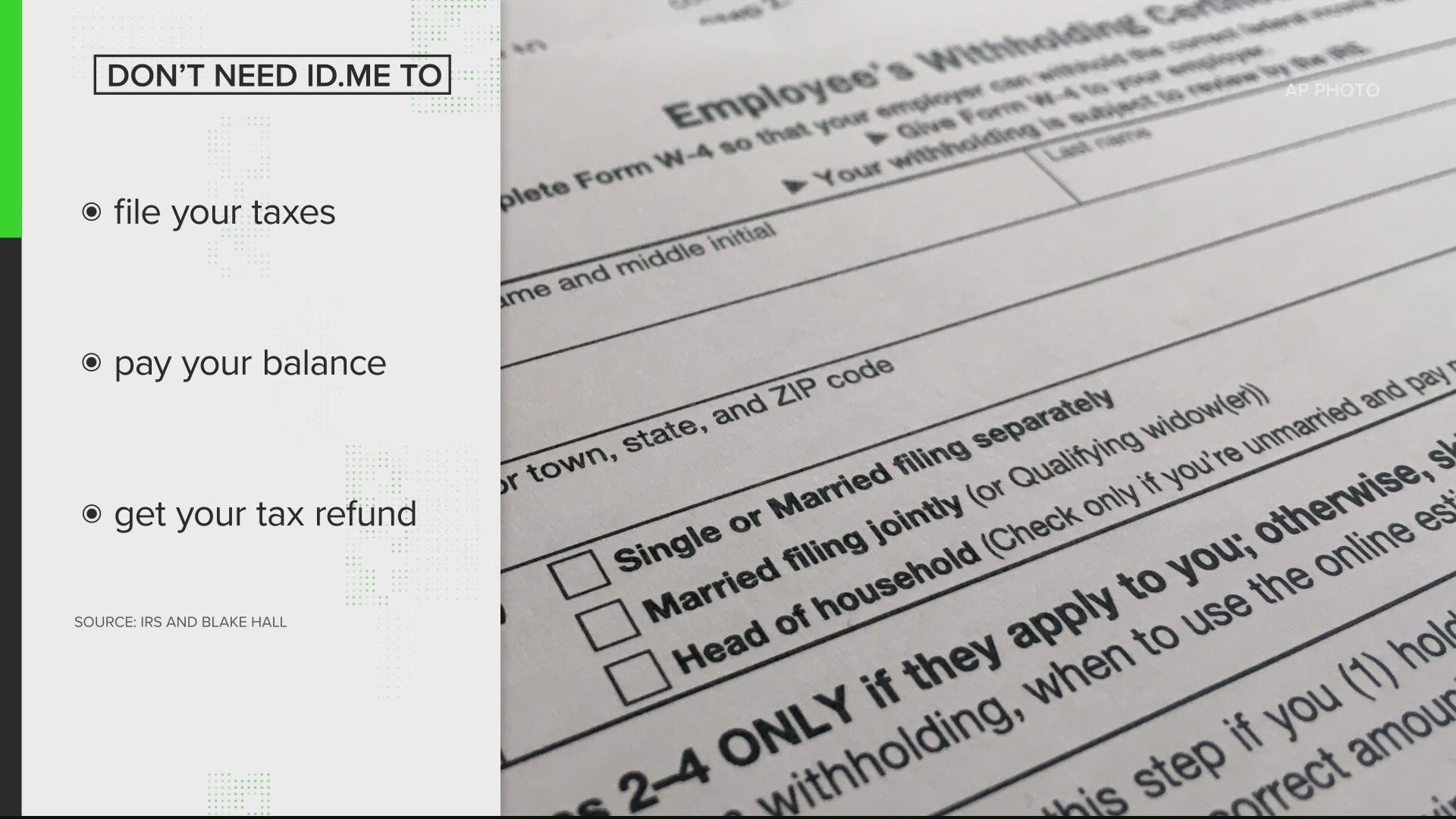

Both a spokesperson for the IRS and Blake Hall confirmed that you do not need to create an ID.me account to file your taxes, pay your balance or get a tax refund.

“That's complete misinformation," Hall said. "We are a secure way to verify who you are, so that you can get access to digital services."

Our Verify researchers also contacted the IRS and were sent this statement:

"There have been some wildly inaccurate statements regarding the use of selfies relating to paying and filing taxes. The IRS emphasizes taxpayers can pay or file their taxes without submitting a selfie or other information to a third-party identity verification company. Tax payments can be made from a bank account, by credit card or by other means without the use of facial recognition technology or registering for an account. To help protect the security of taxpayers, the IRS uses an identity verification process for accessing IRS’ self-help tools such as checking your account online and getting a transcript online."

According to the IRS's November press release, you'll need an ID.me account for things like checking if you’re eligible and enrolled for the Advanced Child Tax Credit, getting copies of past tax returns or setting up an Identity Protection PIN that prevents others from filing a tax return for you.

Those will all require you to set up an ID.me account, and yes, take a selfie video.

“It's that selfie step that, you know, even if they have all that information and they could commit identity theft, the reality is they have to put their face in front of a camera, and criminals do not want to do that they will go attack some other programs," Hall said.

Here’s how it works: you create an account by providing your email address, social security number, a photo ID, and the selfie video. You’ll also need to set up multi-factor authentication.

The selfie video helps them make sure you’re really you, when you set up your account, and those one-time codes sent through multi-factor authentication help verify it’s you every time you sign in, an ID.me spokesperson confirmed.

ID.me provides similar services for the Department of Veterans Affairs, the Social Security Administration and and 27 state unemployment agencies, including Virginia, according to Hall.

Those who already have an IRS account, can continue to use the "old system" until "summer 2021," the federal tax agency said. After that, they'll have to make an ID.me account.

So we can verify, no, you won't need to take a selfie to file your taxes this year. But you will if you want to access certain features.

RELATED: Yes, you need to claim the child tax credit on your 2021 return, even if you got advance payments