Imposter scams, in which a scammer pretends to be someone they’re not, were the most common kind of scam in 2022, according to the FTC Consumer Sentinel Network. Among the most popular imposter scams are Social Security scams, in which someone contacts you falsely claiming to be with the Social Security Administration.

Many VERIFY readers have asked us questions asking about potential Social Security scams. We VERIFY five things to watch for so you don’t fall victim.

THE SOURCES

WHAT WE FOUND

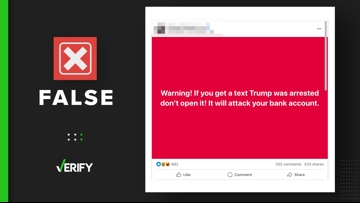

Scammers have posed as government agencies like the Social Security Administration (SSA) for years. Typically, such scammers claim that if you refuse to pay or give them personal information, a government agency will come after you or you’ll miss out on a federal benefit that you’re eligible for, the Federal Trade Commission (FTC) says.

The scammers will use all means of communication — phone call, mail, social media messages and emails — to convince you to send money or give them personal information that could be used to steal your identity.

Here are five signs that you’re dealing with a scammer and not a representative of the Social Security Administration.

You’re threatened for immediate payment

The SSA Office of the Inspector General says that if someone who claims to be with the SSA threatens to suspend your Social Security number, warns of arrest or legal action, threatens to seize your bank account or demands immediate payment, it’s a scam.

The Consumer Financial Protection Bureau (CFPB) says the SSA will never threaten you with arrest or other legal action if you don’t immediately pay a fine or fee.

You can hear an example of such a scam call in a 2018 warning from the FTC. It shows how scammers use the vague guise of “suspicious activity” to scare you into thinking you could be arrested if you don’t clear your name.

But the FTC reminds people that none of these supposed threats are ever real.

“Your Social Security number is not about to be suspended,” the FTC tells people. “Your bank account is not about to be seized.”

The SSA will never ask for immediate or anonymized payment.

You’re told to pay by gift card, cash, wire transfer or cryptocurrency

The SSA says it will never require payment by retail gift card, cash, wire transfer, cryptocurrency or prepaid debit card.

In fact, the CFPB says you should never pay any government fee or fine using those methods. “Scammers ask for payment this way because it’s difficult to trace and recover,” the CFPB says.

Instead, the SSA and the AARP say, you will receive a letter if you do need to submit payments to Social Security.

“If you do owe the agency money — for a benefit overpayment, for example — you'll get an official letter outlining your payment options and appeal rights,” the AARP says.

Typically, your payment options will be either through a secure government portal or payment through your financial institution.

You’re told to provide all or part of your Social Security number

A representative of the SSA will never contact you to ask for personal information, including all or part of your Social Security number, your bank information or your credit card number.

The real SSA already knows your Social Security number, so it won’t need you to verify your number when reaching out to you, Experian, a credit reporting bureau, says. If you initiate a call to an official SSA phone number, you may have to provide your Social Security number to confirm your identity, but in that case, you’ll know you’re talking to the real SSA anyway.

In general, you should always be suspicious if someone calls you or contacts you in any other way to ask for that kind of information, no matter who they say they are.

“Never give your SSN, credit card or bank account number to anyone who contacts you,” the FTC says. “Ever.”

You receive a call, letter, message or email about a problem with your Social Security account

There are very few reasons the SSA will ever need to contact you unsolicited. If there’s a problem with your Social Security account, you’ll usually get a letter in the mail or a notification to your online My Social Security account. If the real SSA is calling you, it’s going to be because you’ve recently been in contact with the SSA already.

“Generally, SSA mainly calls people who have recently applied for a Social Security benefit, someone who is already receiving payments and requires an update to their record, or a person who has requested a phone call from the agency,” the SSA says. “If a person is not in one of these situations, they normally would not receive a call from the agency.”

Scammers will try to make themselves seem legitimate when they contact you. For example, scammers can spoof caller ID to make it look like the call is coming from the SSA. Don’t pick up the phone if you’re not expecting a call or return a missed call. Instead, call the number on the official SSA website to confirm the agency is trying to contact you. That number is 1-800-772-1213.

But just because a letter comes in the mail doesn’t mean it’s automatically safe.

Social Security scammers sometimes send fraudulent letters. They might use real logos, names, titles and agencies in their mailing, and could even provide “evidence” with fake documentation, ID cards and badges, Experian says. One thing the SSA and CFPB recommend you can do to pick out fakes in this case is to look for misspellings and grammatical mistakes.

And, just like with suspicious calls, you should verify other communications by calling the number on the SSA website, rather than any numbers in the letter.

You’re promised a benefit increase in exchange for your action

Sometimes, rather than scare you with a prospective consequence, a scammer might try to lure you in with a potential reward. But these offers are just as fake as the threats.

“SSA employees will never promise to increase your Social Security benefits, or offer other assistance, in exchange for payment,” the CFPB says.

Similarly, they might say you can get extra benefits if you share sensitive personal information, such as your Social Security number. Again, this is a scam.

“The Social Security Administration does offer periodic cost of living increases in benefits to keep pace with inflation, but you don't have to do anything to receive them,” Experian says. “When this increase is doled out, you'll be notified by mail and you won't have to take any action to receive it.”

What should you do if you’ve been scammed?

If you do give your personal information to a Social Security scammer or another government imposter, the FTC recommends you go to IdentityTheft.gov to report the scam and create a recovery plan to protect yourself.

It’s likely any money you pay the scammer is already gone by the time you realize you’ve fallen for a scam. Still, if you catch on early enough, there’s a small chance you might be able to recoup your losses. Read here to learn how.

Whether you fall for the scam or not, you should report any Social Security scams you see to the FTC and the Social Security Administration.