Nearly five months after the Russian ruble hit its weakest level in history against the U.S. dollar, people on social media are talking about declines in another form of overseas currency.

A viral tweet posted on Monday, July 11 claimed that one euro was equal to one U.S. dollar for the first time since 2002. The tweet has since been shared more than 22,000 times.

The euro is the currency of 19 countries within the European Union and over 340 million people who live in Europe.

News headlines from media outlets including the BBC, Forbes, and the New York Times also claimed the euro and U.S. dollar hit parity, or had the same value, for the first time in 20 years.

THE QUESTION

Was one euro equal to one U.S. dollar for the first time in 20 years?

THE SOURCES

- Trading Economics, an economic data and forecasting company

- Tullett Prebon, a financial services firm

- Robin Brooks, chief economist at the Institute of International Finance

THE ANSWER

Yes, one euro was equal to one U.S. dollar for the first time in 20 years. The currency is still hovering near parity with the U.S. dollar as of Friday, July 15.

WHAT WE FOUND

Data from Trading Economics and Tullett Prebon, which provides financial data to news sites including the Wall Street Journal and MarketWatch, show that the euro and U.S. dollar hit parity on Tuesday, July 12. That means a person could exchange one U.S. dollar for one euro if they were traveling abroad to one of the 19 nations within the European Union.

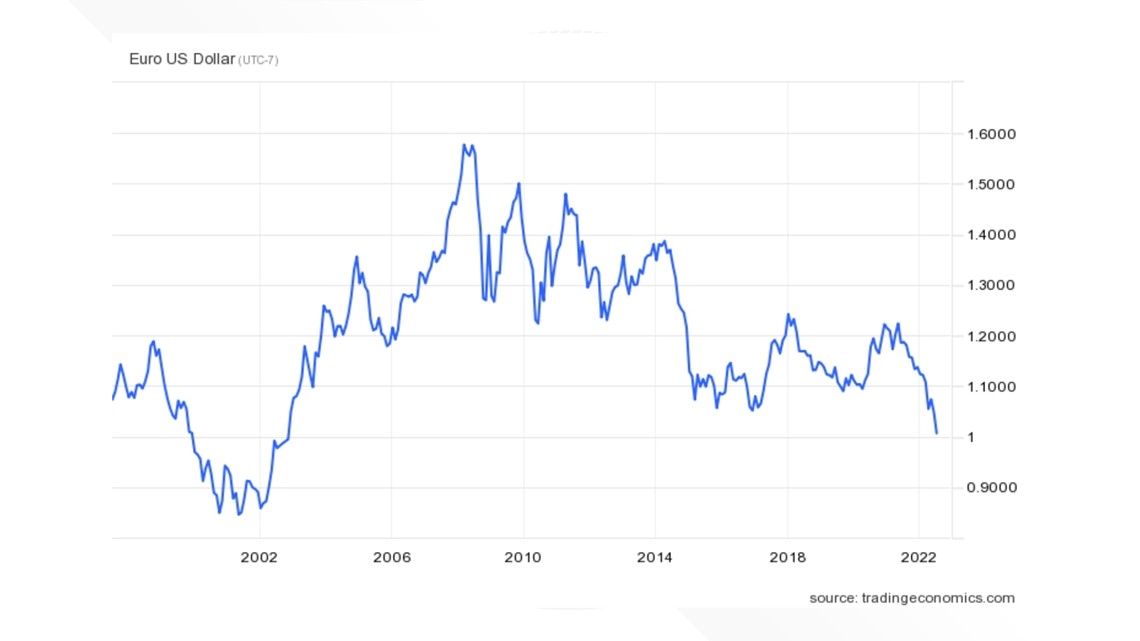

Data from Trading Economics show this marked the first time that euro had an exchange rate of one euro to 1 U.S. dollar since December 2002.

Several days later, on July 14, 2022, the euro also briefly dipped below an equal exchange rate with the U.S. dollar, dropping to a low of about 0.99.

“Maybe on some level parity of Euro versus US Dollar is just a number. But markets are made up of human beings who happen to care about levels, which gives parity a special psychological significance, not least since we haven't seen [the euro less than one U.S. dollar] in 20 years,” Robin Brooks, chief economist at the International Institute of Finance, said in a tweet on July 11. “This is a big deal.”

In January 2022, the exchange rate hovered near one euro to 1.15 USD. The currency began to experience declines later in the year.

One year ago, in July 2021, the exchange rate was hovering above one euro to 1.18 USD.

As of Friday, July 15, the euro is still hovering near parity with the U.S. dollar, data from Tullett Prebon and Trading Economics show.

Trading Economics reported that the euro traded on Friday, July 15 “at around 20-year lows of $1.0006, dragged down by recessionary fears and a bigger discrepancy between the European Central Bank and the [U.S. Federal Reserve].”

Both Brooks and Trading Economics also pointed to soaring natural gas prices and uncertain energy supply due to Russia’s war in Ukraine as other reasons behind the euro’s decline.

“Russia's invasion of Ukraine is a seismic shock for the Euro zone, because so much of the European growth model has been predicated on cheap Russian energy. That's over & done with. Recession & structural headwinds are coming,” Brooks said in a tweet on July 14.

Meanwhile, the U.S. dollar has been surging in value, primarily because the Federal Reserve has raised interest rates more aggressively than central banks in other countries in order to combat record-high inflation, the Associated Press reported on July 7.

The rate hikes cause U.S. Treasury yields to rise, which attracts investors and, in turn, boosts the dollar’s value.

The Associated Press contributed to this report.